16 March 2017

Astute readers will remember that not only did the end of February mark my thirtieth birthday, but the end of my 60 Before 30 project! This was one in a long line of goal sets with a longer time horizon, as I generally prefer them to yearly goals. Though I’ve done a few 101 in 1001s before, this was my first time trying a 60 before 30.

In short, I LOVED it! I think I’ve improved over time at this long-term goal setting thing, because in the past, I’ve been a little over my lists by the time I entered the third or so year of them – but not this time. Though I didn’t complete all 60, I still feel as passionately about each of these as goals as I did three years ago. Partially, that’s because I allowed myself the freedom to replace any goals along the way that were no longer relevant or important to me. I only ended up changing about three, but the freedom to do so was liberating.

To quote myself (ha), “I hope writing these things down and working toward them will help me become the person I want to be — strong in mind, body, and spirit; capable and adventurous; encouraging and kind; grateful and generous — when I reach a new decade.”

So… did it work? I’d say yes! I will never be these things fully in this life, but I do think I am more these things than I was three years ago, and I think this project helped. Plus, I had a lot of fun along the way!

Let’s take a look at how I did! We’ll start with the goals I did not complete (womp womp):

— Host a themed party

— Go on a missions trip

— Make a watercolor, oil, or acrylic painting

— Learn to French braid

— Become a morning person with a consistent morning routine

— Make a square newel post for our stairs

— Convince Nancy to give me a hair tutorial

— Grow a cutting garden with dahlias, roses, and peonies

— Go antiquing at Brimfield, Round Top, Scott’s, Alameda, Brooklyn Flea, or another famous market

— Run a Chick-fil-a 5k

— Create a drop zone near our garage door

— Follow a year-long Bible reading plan with John

— Make a quilt

Just 20%! Not too bad! Alrighty, now for the four goals that were in progress when I crossed the finish line:

— Post a guide to the Triangle on EFM (Easily my most long-suffering goal :))

— Make our porch a comfy place to gather (We made progress, but are still locked in a head-to-head debate over whether a porch swing would “damage the integrity” of our porch ceiling. You can guess which side I’m on.)

— Renovate our backyard so it’s more private and a great place to gather (This is happening!!! More soon.)

— Develop a consistent and fulfilling prayer life (Ongoing, but research has been done and rhythms have been established.)

I won’t list all 43 goals I checked off (you can see them all here!), but I did want to give you a few of the highlights!

The goals I’m most proud of completing: Nos. 12, 13, and 14, paying off our two car loans and fully funding a savings account for our next car purchase

The goal that took the most planning to complete: No. 45, going to Europe (see my posts here: Paris, Provence, Cassis, and the Cote d’Azur)

The goal that’s made the biggest difference in my health: No. 11, making an appointment with an allergist

The goals that stretched me to be more generous than I would have been otherwise: No. 3, supporting a friend in something he or she is doing and no. 27, extravagantly and unexpectedly giving to someone else

The first goal I completed: No. 21, hanging a giant wedding canvas in our living room

The goal that took the longest to complete: No. 43, making a will

The final goal I completed: No. 59. buying a new Bible for the long haul (I eventually decided on the ESV Study Bible)

The most expensive goal I completed: No. 35, paying off at least 35% of our outstanding mortgage

The goal on which I most overachieved: No. 56, making at least one friend in our neighborhood

The goal I’d most like to experience again: No. 29, exploring the California coast (posts here, here, here, here, here, and here)

The goal I least thought I’d do but I DID: No. 4, expanding my very minimal eye makeup techniques (thanks to my personal consult with Sam)

The goals I most loved writing about on EFM: Nos. 18, 19, and 20, sharing about our second, third, and fourth wedding anniversaries

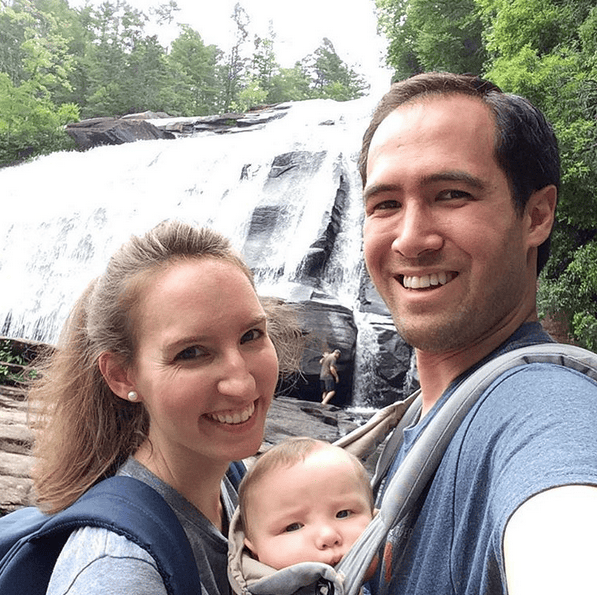

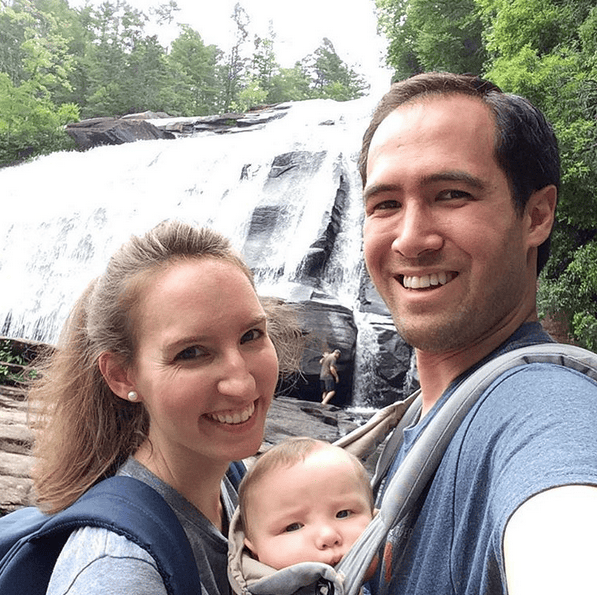

The most-anticipated and sweetest goal: No. 41, expanding our family (the one and only June)

Other favorites: nos. 8, 22, 24, 34, 46, 49, 51, and 54! Really, all of them :)

Anyone else wondering what’s next? Me, too! I already have a pent-up collection of ideas for another list, and just need to figure out the format that makes the most sense. I’m not in a huge hurry, but also already feel the void of not having an ongoing project! Any ideas you want to throw my way? So far, the best I’ve got is something that fills the time until we pay off our mortgage!

13 March 2017

Ever since Brooke wrote about throwing a “Favorite Things” party many moons ago, I’ve wanted to host one myself! The rapidly-approaching end of my 60 Before 30 project was enough to get my butt in gear, and I’m so happy to say that this eagerly-anticipated event was just as fun as I thought it would be. Here’s how I organized mine, in case you’re interested in hosting your own!

Instead of inviting my usual roster of friends, I decided to use this party as an opportunity to get to know our neighbors a bit better. To make things simple, I issued a Facebook invitation. Here’s the text I used in case you’d like to copy it :)

Hi friends and neighbors!

I’ve wanted to host a “favorite things” party for a long time, and figured Valentine’s Day and meeting more neighbors were perfect excuses! :)

If you reply YES (which I hope you do!), plan to bring your favorite thing with you on the 16th (anything you like… your favorite lip balm, favorite kitchen tool, favorite gift wrapping supply, a gift card for your favorite frozen yogurt, favorite plant, etc.). Don’t spend more than $10, and bring THREE of the same thing (for a total of $30 or less). You’ll go home with the favorite things of three other ladies!

If you’d like to bring a dessert or bottle of wine or another drink to share, as well, that would be great! You can comment below with what you’ll bring so we can all get excited :)

Finally, please feel free to extend the invitation to any other ladies you love in [our neighborhood]!!

Looking forward to it!

Emily

Going the Facebook route made it very easy for friends to invite other friends, something I was really trying to encourage! We ended up having three gals attend who I’d never even met before – success!

The party was on a Thursday, starting at 8pm (after kiddos were in bed – another bonus of it being neighborhood-centric was that everyone just walked over, some in slippers, after lights out!). The first half hour or so was spent chatting and eating dessert, the second was spent passing out the “things,” and the third was spent chatting :) For decor, I cherry-picked the Target Dollar Spot on February 15.

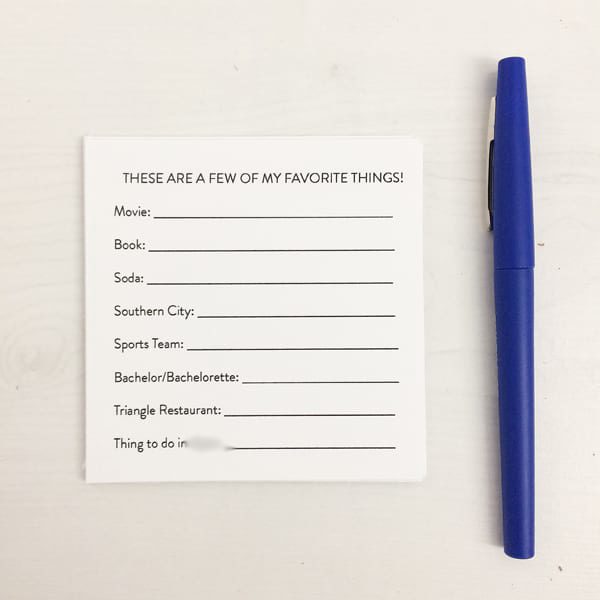

Upon arrival, I had everyone write their names on three slips of paper and fill out one of the interview cards I made:

Then, I read the cards one by one, and everyone tried to guess who had written each. The person who guessed correctly introduced her favorite thing, then drew three slips of paper from the bowl and gave her things to those three guests. We continued until everyone had three new things to go home with!

I had a duo for my favorite thing: EO French Lavender hand soap, which I first smelled at Serenbe and always makes me feel like I’m in a fancy hotel, and a few brownie bites from Whole Foods. If you haven’t tried the latter yet, you probably shouldn’t – they are my ultimate WF weakness. Other gals brought cute socks, a milk frother, a body scrub, a silpat mat and three favorite recipes, and face masks, to name a few.

This was such a fun evening – in fact, we’ve already talked about making it a twice-yearly tradition! I was definitely nervous to put myself out there, especially without my usual crew around me, but I think the “favorite things” aspect actually lowered the pressure, because there was something to “do” instead of just stand around and chat. Highly recommended all around :)

Have you ever been to a Favorite Things party? What would you bring if you were invited to one? It was really hard to decide!

8 March 2017

In my last Marvelous Money post, I shared our current Big Goal: paying off our mortgage early, in the next five years. I’ve had some questions about how and why we are doing that, so I thought we could chat about it today!

Why we are paying off our mortgage early:

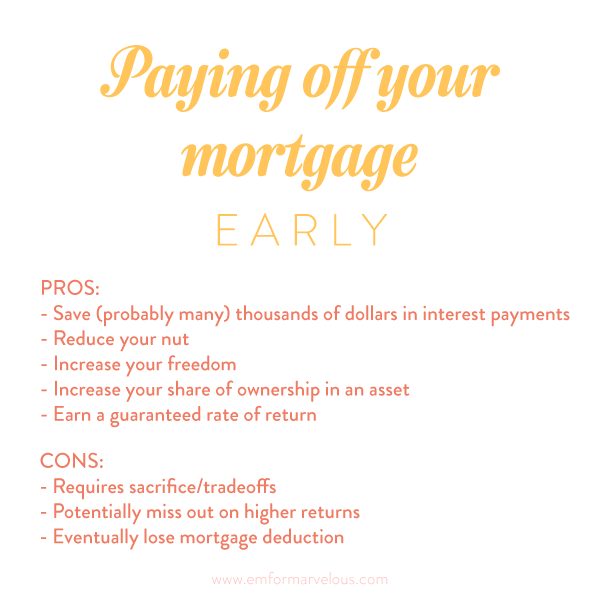

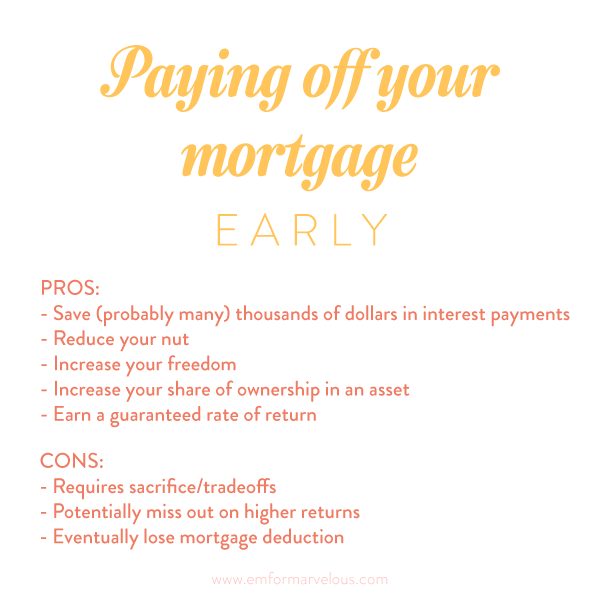

Though paying off our mortgage early seems like a slam-dunk choice to us, there are pros and cons. Here are a few:

To expand a bit on these reasons:

— Save (probably many) thousands of dollars in interest payments: By paying off our mortgage more than 20 years early, John and I will save roughly $120,000 (!!!!!) That is a LOT of vacations and dance lessons and flights to see loved ones and delicious dinners out over a lifetime. That excites us!

— Reduce your nut: Megan McArdle describes your financial “nut” as “the amount of money that you absolutely have to pay every month if you don’t want scary-looking men to start repossessing your possessions.” Think: fixed expenses like car loans, student loans, mortgages, and the electric bill.

— Increase your freedom: The smaller your nut – the fewer obligations you have per month – the more freedom you have. If your nut is tiny, you can quit your job for one you love with a lower salary, or start your own business, or stay home with your kids. You can travel, or support charities that matter to you, or buy the most delicious-looking food at Whole Foods every week.

— Increase your share of ownership in an asset: As you pay off your mortgage, you’re buying more and more of your house from the bank and building equity (money in your pocket if you choose to sell one day!).

— Earn a guaranteed rate of return: You can think of eliminating a future payment as earning a guaranteed rate of return. For example, if your mortgage has a 4% interest rate, you’re effectively earning 4% interest on the money you use to pay off your loan.

On the other hand…

— It requires sacrifice and tradeoffs: This is the hard part, as we already discussed! For us, paying off our mortgage early means forgoing vacations, reducing our grocery budget, delaying clothing purchases, cooking at home, (almost) never going to the movies, not purchasing alcohol, and more.

— You potentially miss out on higher returns: The most common argument against paying off your mortgage early is that if you instead invested those extra payments in the stock market, you could earn a higher rate of return (since the stock market averages 9ish% per year over the long term). While this is true, it’s also true that most people don’t have the willpower to actually set aside that money and watch it build without dipping into it.

— You’ll eventually lose the mortgage deduction when you pay off your mortgage: This is true, but it’s still not a good reason to keep your mortgage, because the math doesn’t work out. Dave Ramsey explains more here, but the upshot is you’d always be paying more in interest than you’d save in taxes.

For us, the freedom and peace of mind we will gain from having no mortgage before June enters school far outweighs the sacrifices we’re making now and the potentially higher returns we’re missing out on.

Photo by Anna Routh – see more of our home here.

So that’s our why! Let’s talk about our how.

Very simply, we’re paying a set amount per month over and above our normal payment. Since we live and die by our budget, we’ve found that budgeting for that expense just like everything else has been the most helpful instead of waiting for “extra” funds to pop up.

When we first started attacking our mortgage three years ago (after we paid off our student loans and car loans), we did the simplest thing: we put the extra money directly toward our mortgage. (Our mortgage lender allowed us to make manual online payments, which we did every month.)

A year and a half ago, however, we decided to take things up one more notch by aiming for the best of both worlds. Since the main critique of paying off a mortgage early is that it doesn’t make sense to pay off a low interest rate mortgage when you could be earning higher rates of return by investing, we decided to invest the extra money we had been paying toward our mortgage.

So, instead of directly applying the money to our mortgage, we now transfer our extra payment (the same amount as before) to a brokerage account every month, where it is invested in a mutual fund. When we reach the full amount we need to pay off our mortgage, we’ll pay it in one lump sum. That will be a sad day for our bank account, but a happy day for our assets :)

A word of caution: I would only consider doing our “next level” system if you have a long track record of steely willpower with your money. It is so tempting to just take a little here or there as we watch that fund grow and other needs come up, but for this plan to work, you have to consider it absolutely untouchable!

Also, this approach requires a willingness to take the risk that the money you’re saving for paying off your mortgage could actually lose value.

If you’re nervous you’d be tempted or don’t want to stomach the risk, just apply the extra payments straight to your mortgage – done and done. Also a fantastic option.

Our master bedroom – photo by Callie Davis

We’ve still got a few years to go, but once we get under $100k owed, I think we’ll make a visual countdown somewhere in our home! I remember watching the Rays $90k chalkboard countdown dwindle month after month whenever we went over for dinner. SO exciting, and such a great teaching opportunity for kids!

One caveat and one piece of encouragement before I sign off of this exceedingly lost post.

Caveat: Paying off your mortgage early may not be the right money goal for you right now. Dave Ramsey considers it baby step 6 of 7, after paying off all other debt, building an emergency fund, and saving for retirement and college. It is an awesome goal, but one you should probably tackle after everything else is squared away.

Encouragement: Just because most Americans have a mortgage doesn’t mean you have to!! When you live like no one else, you get to live like no one else – free from worry about money, and at peace with whatever the future holds. If paying off your mortgage is important to you, I truly believe you can do it! I’ll be cheering you on!!

There’s about a million more things I could add to this post, but I’ll leave it there for now! If you’d like to read more about paying down debt in general (including info about how we freed up enough money in our budget to make our extra payments), click here.

I’d love to hear: Are you hoping to pay off your mortgage early? What financial goal are you working on right now? What’s holding you back from getting ahead with your finances, or where do you feel you need the most help?

6 March 2017

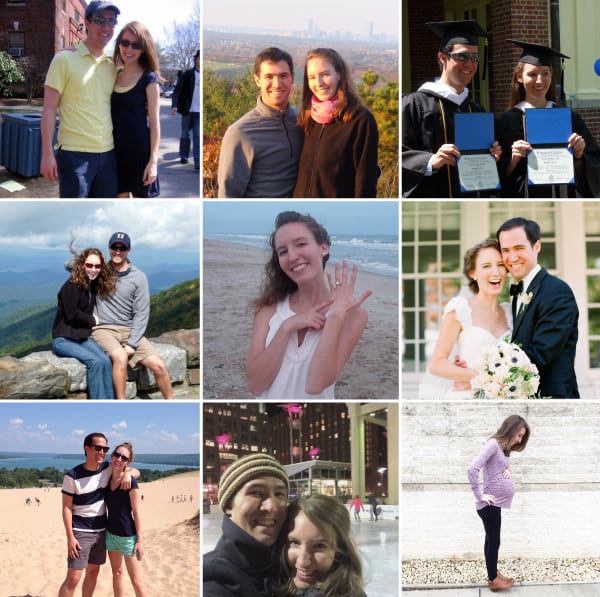

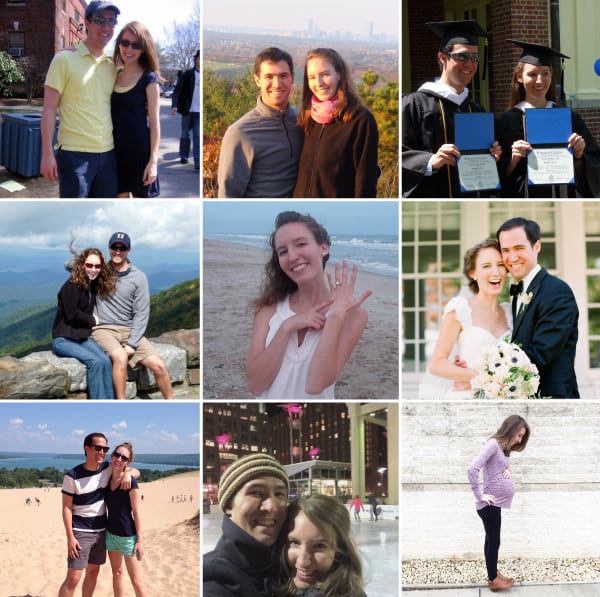

So, 30. Here we are! I wish I could tell you that I’m only feeling joy as I enter a new decade, but the truth is that my feelings are more on the sweet side of bittersweet. I have NO regrets over my 20s, and I want to think that if I wrung as many bits of joy as I could out of each year, I should have no sadness about moving forward.

But that’s just it – my 20s have held such sweetness, so many life events that only happen once – that of course there is a bit of sadness in acknowledging that. Overall, though, I am grateful. And with the love of my life and my precious baby girl at my side, I am believing that the best is yet to come. Besides, my spirit age is 36, so existentially speaking, I’m still a spring chicken :)

One photo from each of the last 10 years – last one below!

10 things I’m proud of from my 20s:

1. Spending the summer in New York City and interning at a wedding magazine

2. Starting Em for Marvelous, fostering the community that has grown here, and using my powers for good :)

3. Writing a book of poetry for my college senior thesis

4. Being hired at my dream job (and still working there eight years later)

5. Adjusting to life in North Carolina

6. Marrying my high school sweetheart

7. Making trade-offs to pay off our student and car loans, save an emergency fund and a car fund, and give sacrificially to our church and others

8. Helping to start a new worshiping community at our church

9. Being a marvelous mama to the sweetest one-year-old

10. Carrying peace and confidence through the ups and downs, which was only possible through an identity firmly rooted in Christ

10 hopes for my 30s:

1. That we will complete our family

2. That we will own our home outright

3. That we will be content in our home, whether it’s the one we have now or not

4. That we will celebrate ten years of marriage with great joy

5. That we will see the family culture we envision being lived out on a daily basis

6. That I will find joy in my work, know the right balance of hours, and have the freedom to live that out

7. That we will continue to value experiences over possessions, exploring new and beautiful places as a family, both down the road and around the world

8. That I will be more fit at 40 than I am now

9. That as much of our family as possible will get to spend more than one week on the Island each summer

10. That I will have the discipline to see continued growth in all areas of my life, especially in my faith, becoming more like Jesus every day

I have wanted to chat about this on EFM forever, so please tell me: what is your actual age, and what is your spirit age? (You can go read Joanna’s post, but basically, your spirit age is how old you think you’ll always feel inside, whether you’re 8 or 80.)